Crypto's Gateway Drug

Stablecoins are cryptocurrencies designed to minimize the effects of price volatility, thus they seek to function as a store of value and a unit of account. To minimize volatility the value of a stablecoin can be pegged to a currency, or to exchange traded commodities.

2018 was the year of the stablecoin.

Increased volatility led to demand for store of value that remained within the crypto ecosystem. This led to more robust and diverse solutions built by talented teams backed by substantial venture capital including DAI/MakerDAO, Trust/TrueUSD, etc… The further maturation of stablecoin solutions increased confidence in the stability of the pegs, driving further adoption.

Critics of cryptocurrencies argue that a core use case still hasn’t emerged and that interest/usage of cryptocurrencies is still concentrated mostly in early adopters.

Stablecoins however represent a powerful gateway to the broader decentralized ecosystem. They are the gateway drug into the broader ecosystem of decentralized applications and distributed data. The maturation of stablecoin solutions is integral to the further adoption of decentralized applications and development of programmable money via smart contracts.

Digital Wallets Adoption in Emerging Markets

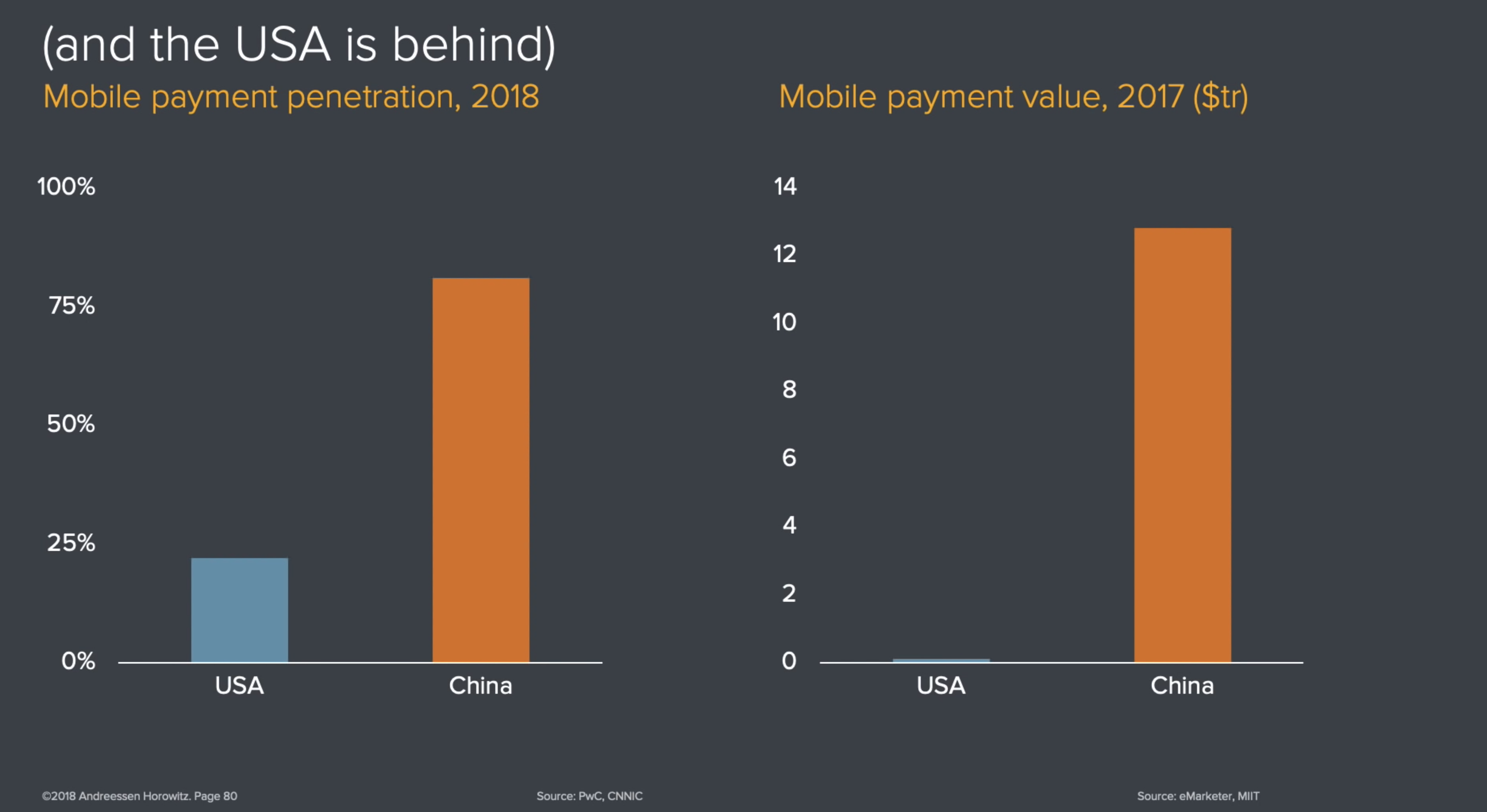

Digital money is here to stay. Digital wallets have proliferated over the past few years in emerging markets, boosted primarily due to the adoption and daily engagement of rideshare and messaging platforms like Grab & GoJek in SE Asia, WeChat in China, PayTM in India and MPesa in Africa.

As a large % of the population in Africa, China, India and SE Asia still remain unbanked or nominally banked, these digital wallets represent an immense opportunity to provide essential banking services (microloans, insurance, etc…) to further enhance economic growth and wellbeing for billions of people globally.

Despite impressive digital wallet penetration rates in these emerging economies, saving and transacting in local currencies can be unpredictable and subject to arbitrary regulations.

Stablecoins have the opportunity to represent a ubiquitous global currency, where digital wallet providers and buyers, sellers, and investors can interact using a global digital currency.

Emerging market instability and unpredictability in monetary policy & governance makes these markets the most likely to adopt new digital wallets that integrate mature stablecoin solutions.

The UX layer for crypto is already happening right under our noses. By providing a familiar and predictable medium of exchange, stablecoins are poised to accelerate mass market cryptocurrency adoption and be one of the first foundational UX components of the decentralized web, serving as a powerful gateway to onboard billions of new crypto users worldwide.